Inventory depreciation calculator

Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. The 200 or double-declining depreciation simply means that the.

Depreciation Formula Examples With Excel Template

Total Cost 20000 6 3000.

. 2 Average cost basis is important because it impacts the net income calculation and profitability figures. Apartment depreciation calculator India. It starts with the large drop in value after the first year then levels out to a lower depreciation rate in the following years.

The value of a built structure decreases due to a. The average cost basisbase value is purchase price minus accumulated depreciation for purchased breeding stock. This tax depreciation method gives you a significant tax deduction in the earliest years.

The formula for total cost can be derived by using the following five steps. The average car depreciation rate is 14. An apartment depreciation calculator is used to understand the value of an apartment at a specific point in time after the construction is completed.

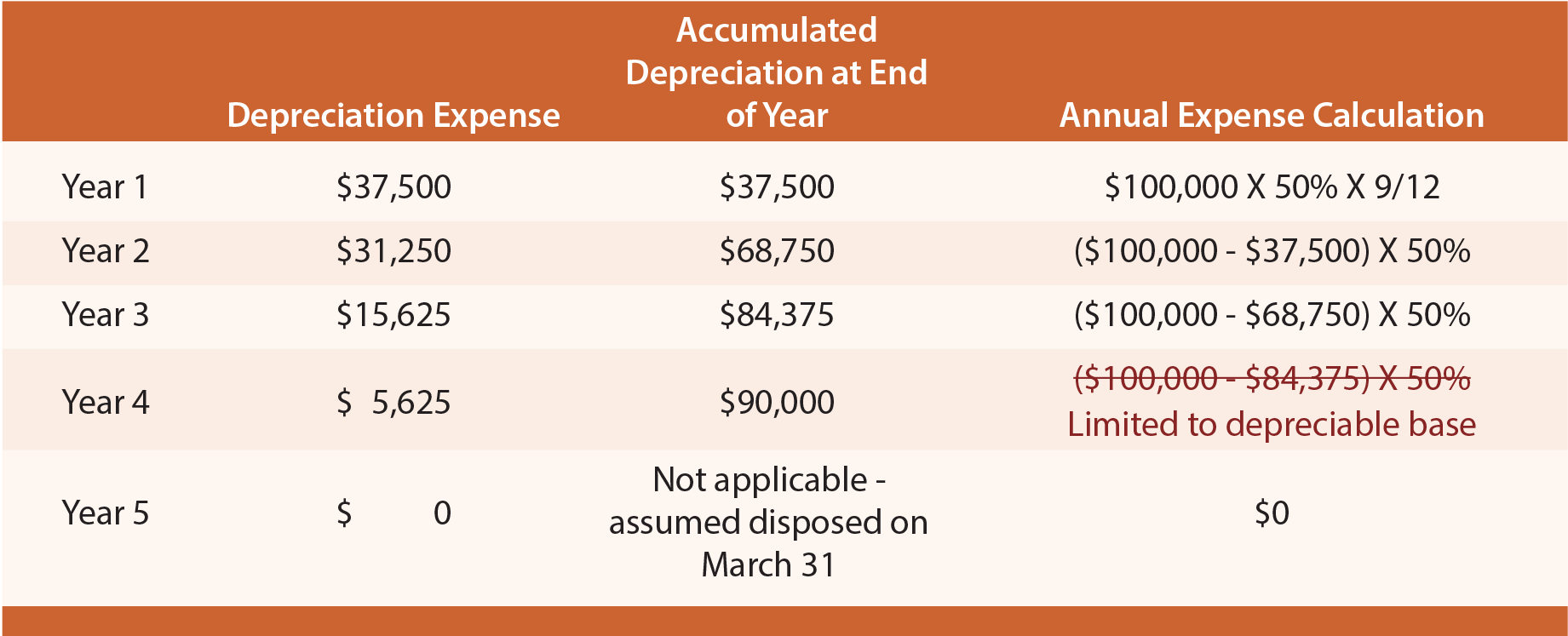

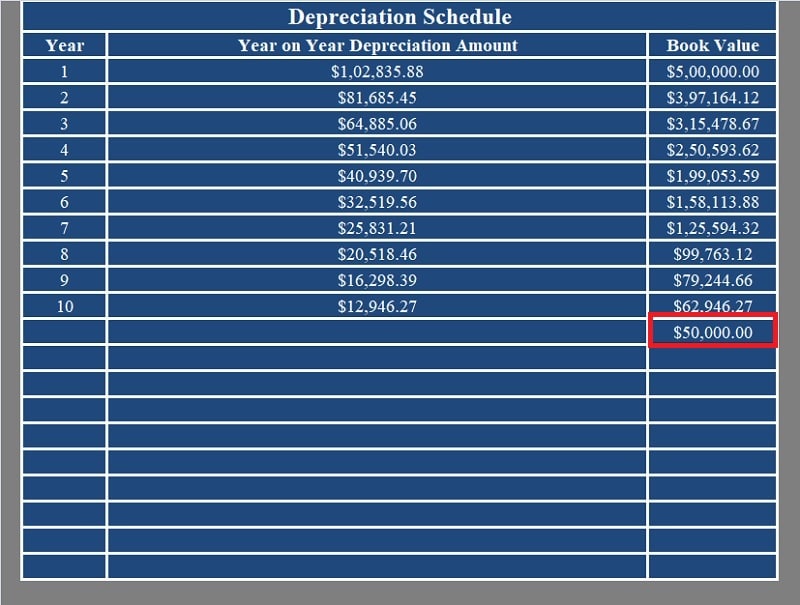

Figure out the assets accumulated depreciation at the end of the last reporting period. Assume a depreciation rate of 30 after the first year and 20 each consecutive year. GDS using 200 declining balance.

A P 1 - R100 n. For example if you have an asset that has a total worth of 10000 and it has a depreciation of 10 per year then at the end of the first year the total worth of the asset is 9000. MACRS depreciation schedule gives you 3 methods under the GDS and 1 depreciation method under the ADS.

These MACRS depreciation methods include. Prepared as per Schedule-II. ABCAUS Excel Depreciation Calculator FY 2021-22 under Companies act 2013 latest version 0504 download.

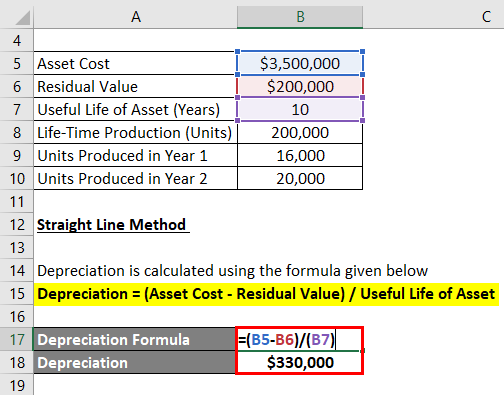

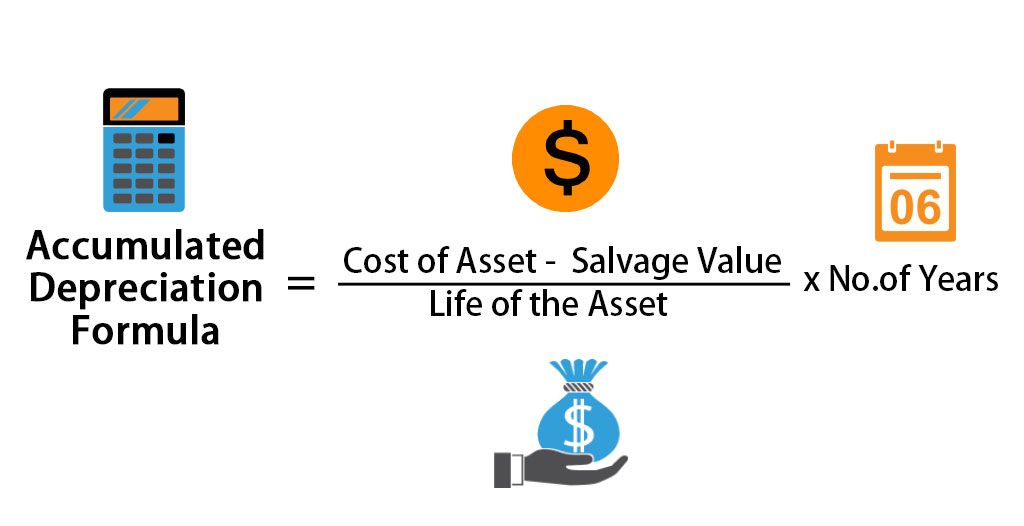

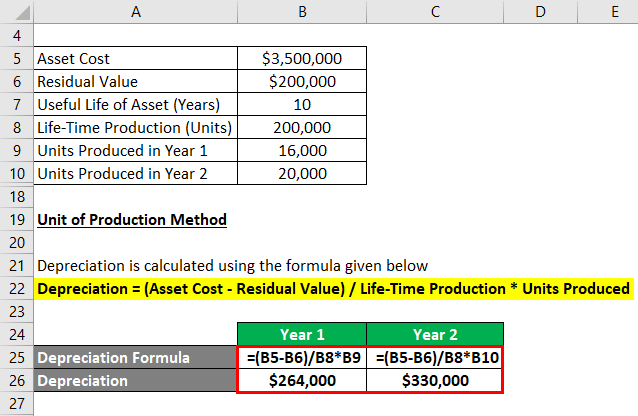

The schedule is presented on an annually. Periodic straight line depreciation Asset cost - Salvage value Useful life no. The algorithm behind this straight line depreciation calculator uses the SLN formula as it is explained below.

To calculate the impact of depreciation compare an example for a commercial truck worth 100000. Percentage Declining Balance Depreciation Calculator When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. That cost which do not change with the change in the level of production.

Some examples of the fixed cost of production are selling expense rent expense. D P - A. Of periods Moreover this also displays a depreciation schedule which consists in this information.

For raised breeding stock it is the base value of the animal the cost of raising the animal to that stage eg. Finally the formula for depreciation can be derived by dividing the difference between the asset cost step 1 and the accumulated depreciation step 8 by the useful life of the asset step 3 which is then multiplied by 2 as shown below. The Car Depreciation Calculator uses the following formulae.

Firstly determine the cost of production which is fixed in nature ie. Total Cost 38000 Explanation.

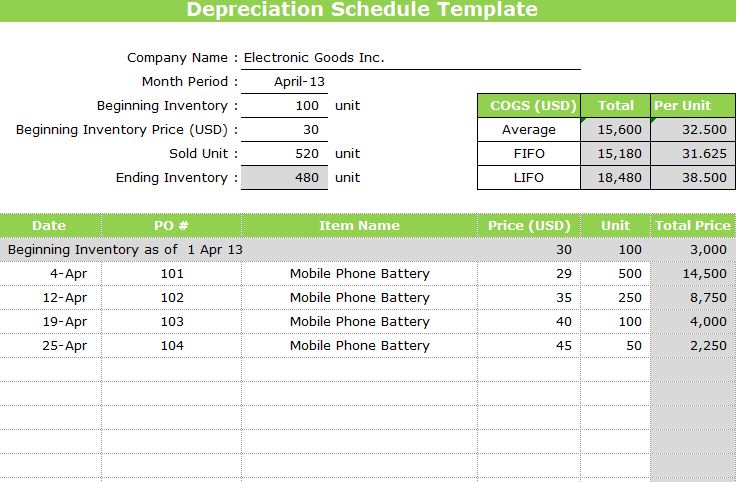

Inventory Formula Inventory Calculator Excel Template

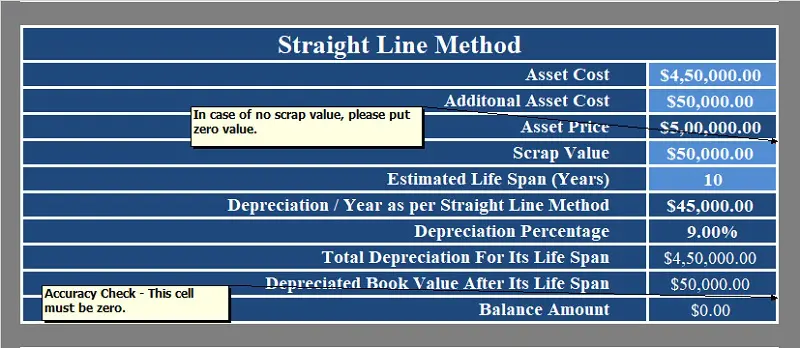

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Formula Examples With Excel Template

Depreciation Schedule Template Depreciation Schedule Excel

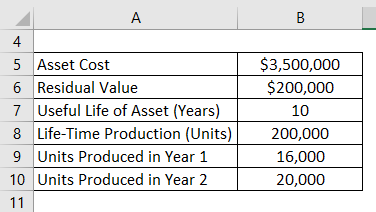

Depreciation Formula Examples With Excel Template

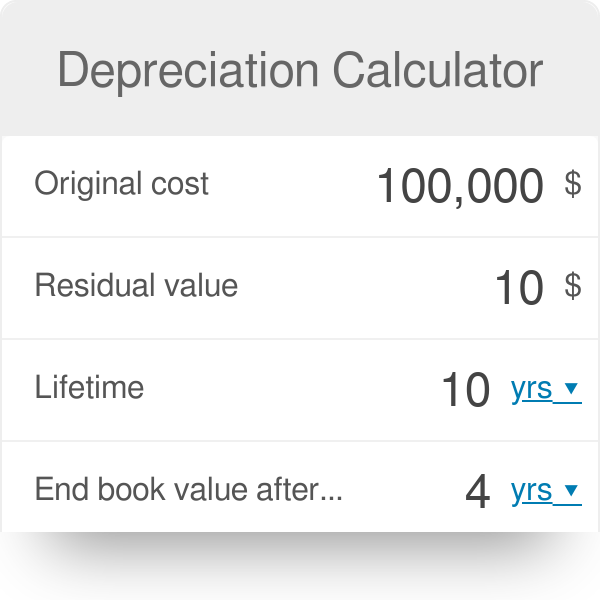

Depreciation Calculator Definition Formula

What Is Accumulated Depreciation How It Works And Why You Need It

Depreciation Methods Principlesofaccounting Com

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Depreciation Calculator

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

Download Depreciation Calculator Excel Template Exceldatapro

Download Depreciation Calculator Excel Template Exceldatapro

Straight Line Depreciation Calculator Double Entry Bookkeeping

Macrs Depreciation Calculator With Formula Nerd Counter

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping